01st May, 2024

Hangor-Class Submarine, 24 hours, NABARD GI, Gold buy, Operational risk, Bank credit, 1000 crore, Payment agregator, Public investment, Hybrid car, NRIs, ISSAR, Net zero, IITM study, Generative AI, Nature journal, Noel Quinn, Kotak Mahindra

- The launching ceremony of the 1st Hangor-Class submarine constructed for the Pakistan Navy was held at Wuhan China.

- International students, including those from India, in Canada, will be able to work off-campus for only up to 24 hours per week starting in September, according to a new rule.

- The NABARD has sanctioned a study on the impact evaluation of Geographical Indication (GI) products to Symbiosis School of Economics.

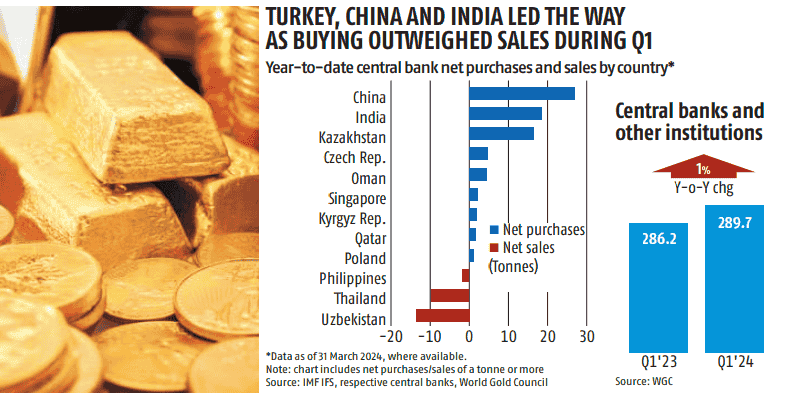

- The Reserve Bank of India (RBI), like most other global central banks, is on a gold buying spree. According to a latest note by the World Gold Council (WGC), the RBI bought 19 tonnes of gold in the first quarter of the current calendar year 2024 (Q1-CY24 / Q4-FY24). This dwarfs the 16 tonnes of gold it bought in the whole of 2023.

- The Reserve Bank of India (RBI) has recently released a guidance note on Operational Risk Management and Operational Resilience in alignment with the Basel Committee on Banking Supervision (BCBS).

- Bank credit growth to non-banking financial companies (NBFCs) slowed to 15.3 per cent year on year in March 2024, against 29.9 per cent a year ago, according to data released by RBI.

- Public sector lender Uco Bank plans to spend Rs 1,000 crore in the financial year 2024-25 to boost Information Technology infrastructure.

- RBI has granted payment aggregator (PA) licence to Groww, and Worldline ePayments.

- Public investment remains an important driver for India, making it the world’s fastest growing major economy, the International Monetary Fund (IMF) said in its latest remarks on the Regional Economic Outlook for Asia and Pacific.

- Hyundai Motor Group has revealed its strategic shift towards hybrid vehicles in India. The company aims to introduce its first hybrid cars in the Indian market as early as 2026. This move comes as the South Korean auto conglomerate seeks to expand its presence beyond electric vehicles (EVs) and solidify its position in this crucial automotive market.

- SEBI has now allowed Foreign Portfolio Investors (FPIs) established in GIFT City to accept unlimited investments from Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs). This opens doors for greater participation from the Indian diaspora in Indian markets.

- Shri S. Somanath, Chairman, ISRO, released the Indian Space Situational Assessment Report (ISSAR) for 2023 compiled by ISRO System for Safe and Sustainable Space Operations Management (IS4OM).

- The International Energy Agency releases a policy brief titled ‘Standards for a Net Zero Iron and Steel sector in India.

- As per an analysis led by scientists at the Indian Institute of Tropical Meteorology (IITM), Pune, from 1950-2020, the Indian Ocean (IO) had become warmer by 1.2°C and climate models expect it to heat up a further 1.7°C–3.8°C from 2020–2100.

- According to a report by Accenture, banks have the potential to significantly enhance their employee productivity and revenues by incorporating Generative AI (GenAI) into their operations.

- The melting of polar ice due to human-driven climate change has slightly slowed the Earth’s rotation – and it could affect how we measure time, according to a study published in the Nature journal.

- Noel Quinn, the Group Chief Executive of HSBC is set to retire from his position after nearly five years.

- KVS Manian, the Joint Managing Director of Kotak Mahindra Bank, has resigned from his position with immediate effect. He had been re-designated to this role on March 1, 2024. In his resignation letter, Manian cited his decision to pursue other opportunities in the financial services sector

Table of Content

International News

- Pakistan Navy Launches First Hangor-Class Submarine In China

- What: The launching ceremony of the 1st Hangor-Class submarine constructed for the Pakistan Navy was held at Wuhan China.

- This was the first of eight submarines of this class that the Pakistan Navy is set to induct into its fleet by 2028.

- Tell me more:

- Pakistan’s Hangor class is the direct counterpart of India’s Kalavari class of submarines, based on the French Scorpene class. India currently operates six Kalavari class submarines.

Source: Indian Express

- Pakistan’s Hangor class is the direct counterpart of India’s Kalavari class of submarines, based on the French Scorpene class. India currently operates six Kalavari class submarines.

| Knowledge Nuggets - |

|---|

|

About Kalvari class submarines: - Built by Mazagon Dock Shipbuilders Limited under Project-75, these are adaptations of French Scorpeneclass submarines. - These have diesel-electric propulsion systems and are primarily attack submarines. - India operates six Kalvari class submarines, namely Kalvari, Khanderi, Karanj, Vela, Vagir, Vagshir. - Three more Kalvari class submarines set to be inducted into service by the early 2030s. - Indian Navy is installing an indigenously developed Air Independent Propulsion (AIP) system to these submarines. ♦ AIP system allows non-nuclear submarines to remain submerged for longer period. |

- Foreign students in Canada to work only 24 hrs a week from September

- What: International students, including those from India, in Canada, will be able to work off-campus for only up to 24 hours per week starting in September, according to a new rule.

- The temporary policy allowing students to work more than 20 hours per week off campus will come to an end on April 30, 2024, and it will not be extended.

- Why: The government wants that students who come to Canada must be here to study.

As such, allowing students to work up to 24 hours per week will ensure they focus primarily on their studies, while having the option to work, if necessary.

Source: News18

- What: International students, including those from India, in Canada, will be able to work off-campus for only up to 24 hours per week starting in September, according to a new rule.

Banking and Economy

- NABARD sanctions study to evaluate impact of GI certified products

- What: The National Bank for Agriculture and Rural Development (NABARD) has sanctioned a study on the impact evaluation of Geographical Indication (GI) products to Symbiosis School of Economics.

- A geographical indication or GI is a sign used on products that have a specific geographical origin and possess qualities or a reputation that are due to that origin.

- Why: This particular study will enable NABARD to analyse the benefits accrued to artisans/producers because of the GI tags over the years

- Tell me more:

- As of today, 144 products supported by NABARD, are GI tagged. The first product that received a GI tag with support from NABARD, was Pochampally Ikat from the State of Telangana (erstwhile united Andhra Pradesh).

- NABARD, not only supports GI registration of a product, but also focuses on post-registration activities, such as registration of authorised users, renewal of existing registration, marketing support, consumer awareness and training programmes, among others.

- A few years ago, NABARD with the help of an NGO, came out with a GI catalogue in French and Spanish which will help the products get an international audience.

- NABARD also help artisans and those associations who have bagged the GI tag to participate at expos at the national-level. Exclusive stores for GI products have been set up with the support from NABARD in Ernakulam (Kerala) and Varanasi (Uttar Pradesh)

- According to details shared by NABARD, so far, it has sanctioned projects for registration of 15,820 producers/manufacturers of GI products as authorised users, providing them the exclusive right to use registered GI.

Source: The HINDU

- What: The National Bank for Agriculture and Rural Development (NABARD) has sanctioned a study on the impact evaluation of Geographical Indication (GI) products to Symbiosis School of Economics.

- Globally Central Banks including RBI look forward to buy gold excessively

- What: The Reserve Bank of India (RBI), like most other global central banks, is on a gold buying spree. According to a latest note by the World Gold Council (WGC), the RBI bought 19 tonnes of gold in the first quarter of the current calendar year 2024 (Q1-CY24 / Q4-FY24). This dwarfs the 16 tonnes of gold it bought in the whole of 2023.

- Why is the RBI buying gold: There are two main reasons why central banks, including the RBI, have been buying gold.

- First, ever since the US put an embargo on payments to Russian companies through SWIFT as well as froze Russian assets in US treasuries, countries are looking to diversify their forex assets.

- During uncertain economic conditions, gold tends to appreciate, balancing the overall reserves when other major currencies decline in value.

- As global inflation inches up, central banks seek to protect their reserves. Rising inflation erodes the value of major currencies, including the U.S. dollar.

- First, ever since the US put an embargo on payments to Russian companies through SWIFT as well as froze Russian assets in US treasuries, countries are looking to diversify their forex assets.

Source: The Hindu Business Line

- RBI proposes to bring NBFCs, co-ops under operational risk norms

- What: The Reserve Bank of India (RBI) has recently released a guidance note on Operational Risk Management and Operational Resilience in alignment with the Basel Committee on Banking Supervision (BCBS).

- Operational risk has been defined as the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events.

- Why: The 2005 guidance, which will be repealed, was initially aimed solely at commercial banks.

- This guidance extends to regulated entities, including non-banking finance companies (NBFCs) and primary urban cooperative banks, as well as central cooperative banks.

- Tell me more:

- The expansion is driven by the need to strengthen entities’ ability to withstand operational risk-related events such as pandemics, cyber incidents, technology failures, and natural disasters. These events could lead to significant operational failures or widespread disruptions in financial markets.

- The guidelines propose a three lines of defense model for operational risk management (The central bank said lenders must apply three lines of defense in operational risk management structure.)

- First Line: The first is business unit management responsible for identifying and managing the risks inherent in the products, services, activities, processes and systems of lenders.

- Second Line: Second is an independent organisational risk management function which develops an independent view on business units’ operational risk, design and effectiveness of key controls and other risk tolerance threshold.

- Third Line: Third line must be the audit function, which should not be involved in development or implementation of the operational risk management processes.

Source: Business Standard

- What: The Reserve Bank of India (RBI) has recently released a guidance note on Operational Risk Management and Operational Resilience in alignment with the Basel Committee on Banking Supervision (BCBS).

- Bank credit growth to NBFCs, personal loans moderate in March: RBI data

- What: Bank credit growth to non-banking financial companies (NBFCs) slowed to 15.3 per cent year on year in March 2024, against 29.9 per cent a year ago, according to data released by RBI.

- Why: This deceleration is primarily attributed to the growth moderation in personal loans, which is mainly unsecured loans. In November last year, the RBI increased the risk weight of unsecured loans from 100% to 125% to address risks associated with such lending.

- Tell me more:

- Retail loans growth also moderated to 17.7 per cent year-on-year in March 2024, down from 21.0 per cent a year earlier, primarily due to decelerated growth in vehicle loans and other personal loans, which are mainly unsecured loans.

- Loan to industries: The credit growth to industries grew by 8.5 per cent year-on-year in March up from 5.6 per cent in March 2023. Among major industries, growth in credit to ‘chemicals & chemical products’, ‘food processing’, and ‘infrastructure’ accelerated in March 2024 compared with the previous year, while that to ‘basic metal & metal products’ moderated.

- Credit to service sector: Credit growth to services sector also saw an improvement, rising to 20.2 per cent year-on-year in March 2024 from 19.6 per cent the previous year, driven by increased credit to ‘transport operators’ and ‘commercial real estate’.

- Credit growth in agriculture and allied activities remained robust, reaching 20.1 per cent year-on-year in March 2024, up from 15.4 per cent in the corresponding month a year ago.

- Non-food bank credit registered a growth of 16.3 per cent during the month as compared with 15.4 per cent a year ago.

Source: Business Standard

- Uco Bank plans ~1,000 crore technology spend in FY25

- What: Public sector lender Uco Bank plans to spend Rs 1,000 crore in the financial year 2024-25 to boost Information Technology infrastructure.

- Why: This substantial investment comes as a strategic move to bolster the bank’s digital capabilities and improve its services

- Tell m more:

- Notably, in the preceding fiscal year (2023-24), the bank’s technology spending amounted to ₹700 crore.

- The bank plans to open 130 branches during FY25 in districts where it does not have any presence.

Source: Business Standard

- Groww Pay, Worldline get nod to be e-payment aggregators

- What: RBI has granted payment aggregator (PA) licence to Groww, and Worldline ePayments.

- The number of firms getting the RBI nod to operate as payment aggregators has touched 20 in the first four months of calendar year 2024.

- Groww has secured the licence for its UPI payments platform Groww Pay.

Source: Money Control

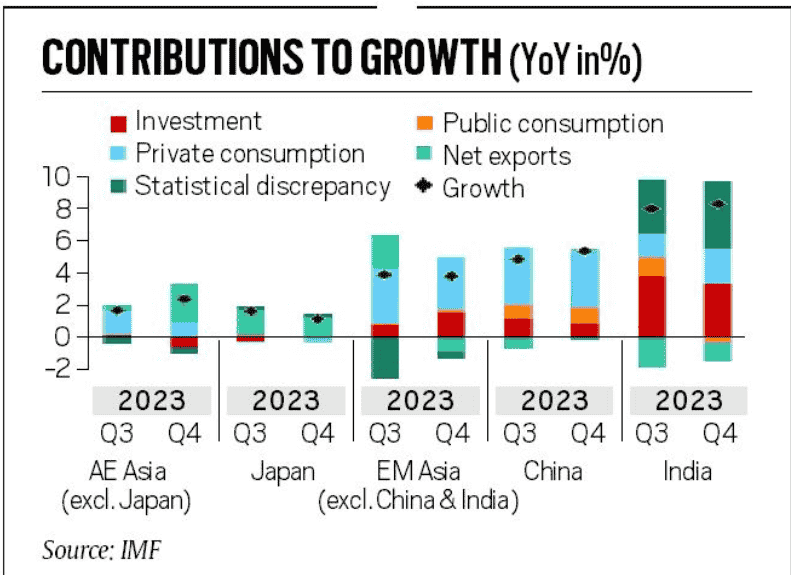

- Public investment remains an important driver for India’s growth, says IMF

- What: Public investment remains an important driver for India, making it the world’s fastest growing major economy, the International Monetary Fund (IMF) said in its latest remarks on the Regional Economic Outlook for Asia and Pacific.

- Tell me more:

- The IMF also said that headline inflation may see further reductions due to lower energy prices in several economies in the Asia and Pacific region, but in India, pressures on food prices, particularly for staple items like rice, may counteract this trend, potentially slowing down the overall decrease in inflation.

- The IMF has also raised the regional growth forecast for Asia and Pacific to 4.5 per cent, up 0.3 percentage point from six months earlier, reflecting upgrades for China, where policy stimulus is expected to provide support. But the growth forecast for the region is slower than 5 per cent growth in 2023.

- Growth rate for China, the world’s second-largest economy, is projected to slow from 5.2 per cent in 2023 to 4.6 per cent this year and 4.1 per cent in 2025.

Source: Business Standard

- Hyundai Motor plans to launch first hybrid car in India by 2026

- What: Hyundai Motor Group has revealed its strategic shift towards hybrid vehicles in India. The company aims to introduce its first hybrid cars in the Indian market as early as 2026. This move comes as the South Korean auto conglomerate seeks to expand its presence beyond electric vehicles (EVs) and solidify its position in this crucial automotive market.

Source: Business Today

- What: Hyundai Motor Group has revealed its strategic shift towards hybrid vehicles in India. The company aims to introduce its first hybrid cars in the Indian market as early as 2026. This move comes as the South Korean auto conglomerate seeks to expand its presence beyond electric vehicles (EVs) and solidify its position in this crucial automotive market.

- Sebi allows NRIs to own up to 100% in global funds at the GIFT City

- What: SEBI has now allowed Foreign Portfolio Investors (FPIs) established in GIFT City to accept unlimited investments from Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs). This opens doors for greater participation from the Indian diaspora in Indian markets.

- Tell me more:

- What’s changed:

- Previously: NRIs and Overseas Citizens of India (OCIs) could only invest up to 50% in a Foreign Portfolio Investor (FPI).

- Now: NRIs can own up to 100% of a global fund set up at GIFT City, a special economic zone in Gujarat.

- What are the benefits?

- More investment options for NRIs: This opens doors for NRIs to invest a larger portion of their money in Indian stocks through global funds.

- Potential for increased investment flows: This move could attract more investment from the Indian diaspora into the Indian stock market.

- What’s the catch?

- Disclosure Requirements: To ensure transparency, any FPI taking advantage of this rule will need to provide SEBI with details of all its NRI/OCI investors, including their Permanent Account Number (PAN) cards and their investment amount.

- To maintain transparency, stricter disclosure rules apply to funds with significant holdings in a single Indian group or large overall holdings in Indian equities. Funds with over 33% of their equity assets under management (AUM) in one Indian group company will need to provide detailed investor information.

- Similar disclosures are required if the fund, along with its investor group, holds more than Rs 250 billion (around $3 billion) in Indian equities.

- SEBI, made some important decisions to encourage Foreign Portfolio Investment (FPI) in GIFT City. Here are the key changes:

- Increased flexibility for passive funds: Normally, mutual funds can’t put more than 25% of their money into companies linked to their own group. But SEBI has raised this limit to 35% for passive funds. However, there are conditions:

- Index replication: This lets passive funds mirror the index they track more closely, especially if the index has a lot of companies from the same group (more than 25%).

- SEBI-approved indices: Only indices approved by SEBI can benefit from this.

Overall cap of 35%: The total investment in group companies can’t go over 35%.

- Increased flexibility for passive funds: Normally, mutual funds can’t put more than 25% of their money into companies linked to their own group. But SEBI has raised this limit to 35% for passive funds. However, there are conditions:

- Improving access to the bond market:

- SEBI has also made it easier for people to invest in bonds issued in India. They reduced the minimum investment from Rs 100,000 to Rs 10,000. This means smaller investors can now get into bond investments more easily.

Source: Business Standard

- SEBI has also made it easier for people to invest in bonds issued in India. They reduced the minimum investment from Rs 100,000 to Rs 10,000. This means smaller investors can now get into bond investments more easily.

- What’s changed:

Reports and Indices

- The Indian Space Situational Assessment Report (ISSAR) for 2023 released by ISRO

- What: Shri S. Somanath, Chairman, ISRO, released the Indian Space Situational Assessment Report (ISSAR) for 2023 compiled by ISRO System for Safe and Sustainable Space Operations Management (IS4OM).

- Why: Space assets face risks from asteroids, comets, and space debris. Space Situational Awareness (SSA) is crucial for safe and sustainable space operations. ISRO monitors the space environment for ongoing safety.

- Tell me more:

- The report has revealed that more space objects were placed in orbit in 2023 compared to the previous year, indicating a growing trend in the space object population.

- Global Scenario

- During the year, more space objects were placed in orbit compared to the previous year

- During 2023, more objects (3143 objects) were placed in orbit compared to 2022 (2533 objects).

- There were five major on-orbit break-up events in 2023, adding to space debris.

- On-orbit break-up events refer to instances where satellites or other space objects break apart while in orbit around the Earth.

- Indian Scenario

- From the start of India’s space journey until 31st December 2023, 127 Indian satellites have been sent into space.

- In 2023, all seven launches of ISRO including Chandrayaan-3 and Aditya L-1 were successful.

- Risk to Space Assets:

- There is an increasing trend in Collision Avoidance Manoeuvres (CAMs) to safeguard the operational spacecraft in case of close approaches by other space objects.

- CAMs are proactive maneuvers conducted by space agencies or satellite operators to prevent potential collisions between operational spacecraft and other space objects.

- There is an increasing trend in Collision Avoidance Manoeuvres (CAMs) to safeguard the operational spacecraft in case of close approaches by other space objects.

- Concerns with Space Object population growth:

- Risks to spacecraft operations: India had to carry out 23 CAMs to protect Indian space assets.

- Kessler syndrome: A phenomenon in which the junk in orbit around Earth reaches a point where it just creates more and more space debris.

- Threat to astronauts’ lives due to space debris.

Source: ISRO

- Standards for a net zero iron and steel sector in India- released by IEA

- What: The International Energy Agency releases a policy brief titled ‘Standards for a Net Zero Iron and Steel sector in India.

- The Policy brief focuses on standards for low and near-zero emissions steel, including emissions measurement methodologies, or emissions thresholds.

- Tell me more:

- India is the second-largest steel-producing country in the world, accounting for 7% of total crude steel production. Both domestic demand and production are set to rise faster in the coming years in India than in any other single large economy.

- Unless mitigation policies are put in place, emissions from the sector are also set to rise rapidly, posing climate, air quality, and stranded asset risks.

- Measures required to standardize Steel Sector

- Setting clear timelines for emissions reduction, measurement methodologies, and defining near-zero steel.

- Creating markets for low-emissions materials and products, developing novel emissions reduction technologies.

- Developing policies to support commercial-scale low-emissions production and mobilizing finance and investment.

Source: IEA

- What: The International Energy Agency releases a policy brief titled ‘Standards for a Net Zero Iron and Steel sector in India.

| Knowledge Nuggets - |

|---|

|

About the Steel sector - India is second-largest steel-producing country, accounting for 7% of total crude steel production. - Steel production is highly reliant on coal, used as reducing agent to extract iron from iron ore and provide carbon content needed in steel. - It is the largest coal consumer and is responsible for 7–9% of global Greenhouse Gas emission. - India’s Steel industry accounts for 12% of carbon dioxide emissions and are expected to double by 2030 due to infrastructure push of the government. |

- Warming of Indian Ocean to accelerate: IITM study

- What: As per an analysis led by scientists at the Indian Institute of Tropical Meteorology (IITM), Pune, from 1950-2020, the Indian Ocean (IO) had become warmer by 1.2°C and climate models expect it to heat up a further 1.7°C–3.8°C from 2020–2100.

- Tell me more:

- Marine heatwaves are when the water in the ocean becomes unusually warm for an extended time. These marine heatwaves are expected to become much more common, increasing from about 20 days a year to 220-250 days a year.

- Maximum warming is in the Arabian Sea.

- In a high emission scenario, the minimum average temperature in the IO basin is to stay above 28°C by 2100, which remained around 26°C-28°C during 1980-2020.

- The Indian Ocean Basin refers to the region encompassing the Indian Ocean and the surrounding landmasses, including countries bordering the Indian Ocean.

Source: The Hindu

- The Indian Ocean Basin refers to the region encompassing the Indian Ocean and the surrounding landmasses, including countries bordering the Indian Ocean.

- Banks could boost revenues by 6% with Generative AI: Accenture report

- What: According to a report by Accenture, banks have the potential to significantly enhance their employee productivity and revenues by incorporating Generative AI (GenAI) into their operations.

- The company modelled the financial implications for over 150 large banks globally, including Indian public and private sector banks, over a three-year period.

- Tell me more:

- Revenue Boost: Banks that swiftly scale generative AI across their organizations could witness an increase in their revenues by up to 600 basis points (bps) over a three-year period.

- But don’t you guys think that revenue is measured in Rupees, millions, or billions, here why we are measuring the revenue in basis points.

- A basis point is equal to one-hundredth of a percentage point (1% = 100 basis points). It is commonly used to express small changes in interest rates, fees, or other financial metrics.

- When we say that banks could boost revenues by up to 600 basis points (bps), we are referring to a potential increase in revenue as a percentage of their existing revenue. It’s a way to quantify the impact of adopting generative AI on overall financial performance.

- Employee Productivity: By effectively adopting and scaling generative AI, banks could enhance employee productivity by up to 30%. This improvement would result from streamlining various language-related tasks using AI technology

- Operating Income and Cost Savings: The study suggests that operating income could increase by around 20%, while return on equity levels could rise by 300 bps.

- Additionally, generative AI could lead to 1-2% cost savings, with cost-to-income ratios declining by up to 400 bps.

- It said 41 per cent of all banking occupation have a high potential for automation.

Source: Business Standard

- But don’t you guys think that revenue is measured in Rupees, millions, or billions, here why we are measuring the revenue in basis points.

- Revenue Boost: Banks that swiftly scale generative AI across their organizations could witness an increase in their revenues by up to 600 basis points (bps) over a three-year period.

Science and Tech

- Climate change has ‘slowed the Earth’s rotation’ study suggests

- What: The melting of polar ice due to human-driven climate change has slightly slowed the Earth’s rotation – and it could affect how we measure time, according to a study published in the Nature journal.

- Earth rotates on its axis relative to the Sun every 24 hours mean solar time, with an inclination of 23.45 degrees from the plane of its orbit around the Sun.

- Tell me more:

- Earth’s rotation is affected by some major geophysical processes –

- Earth’s core: Changes in the flow of currents in the molten outer core affect its spin.

- Glacial melt: The melting of polar ice leads to a redistribution of water mass throughout the oceans, causing a pooling effect around the equator. This redistribution affects the Earth’s shape, making it flatter, and consequently slows down its rotation speed.

- Although the disappearance of the ice has reduced the speed of the planet’s rotation, the Earth is still spinning a bit faster than it used to.

- The overall increase in speed means that for the first time in history, world timekeepers may have to consider subtracting a second from our clocks.

- This means clocks may have to skip a second – called a “negative leap second” – around 2029 to keep universal time in sync with the Earth’s rotation.

- If it wasn’t for the impact of melting ice, the time change would have been needed three years earlier in 2026.

- In recent decades, the Earth has rotated faster due to changes in its core but the melting ice has counteracted this burst of speed.

Source: BBC

- Earth’s rotation is affected by some major geophysical processes –

- What: The melting of polar ice due to human-driven climate change has slightly slowed the Earth’s rotation – and it could affect how we measure time, according to a study published in the Nature journal.

| Knowledge Nuggets - |

|---|

| - Historically, Coordinated Universal Time (UTC) is followed as time standard, in which a day lasts 86,400 seconds (24 hours * 60 minutes * 60 seconds). - However, the average length of a day depends on Earth’s rotation speed. - In case of fluctuations in Earth’s rotation speed, leap seconds are added to UTC. - A negative leap second is subtracted in case of slowing of Earth’s rotation while a positive leap second is added to compensate for speeding up of Earth’s rotation. |

Appointment

- HSBC CEO Noel Quinn quits

- What: Noel Quinn, the Group Chief Executive of HSBC is set to retire from his position after nearly five years.

Source: Live Mint

- What: Noel Quinn, the Group Chief Executive of HSBC is set to retire from his position after nearly five years.

- Kotak Mahindra joint MD K V Subramanian resigns

- What: KVS Manian, the Joint Managing Director of Kotak Mahindra Bank, has resigned from his position with immediate effect. He had been re-designated to this role on March 1, 2024. In his resignation letter, Manian cited his decision to pursue other opportunities in the financial services sector.

Source: Economic Times

- What: KVS Manian, the Joint Managing Director of Kotak Mahindra Bank, has resigned from his position with immediate effect. He had been re-designated to this role on March 1, 2024. In his resignation letter, Manian cited his decision to pursue other opportunities in the financial services sector.

About Anuj Jindal

━━━━━

Anuj Jindal, the founder, is an ex-manager from SBI, with an M.Com from Delhi School of Economics. He also has a JRF in Commerce & Management and NET in HRM, along with more than 5 years of experience in the field of Education.

0 Comments