17th April, 2024

Crowdfunding, 18GW renewable energy, mining truck, Nigeria introduces new 5-in-1 vaccine, deepfake images, AI chips for China market, Microsoft invests $1.5 bn, Urban Cooperative Banks (UCBs), Bain Capital, Jana Small Finance Bank partners with Kotak Mahindra Life, IdeationX, IMGC ties up with Bank of India, Zee removed from F&O, weigh derivatives risk, auto claims processing, India’s outward FDI, RBI conducts 2-day VRRR, UCB advances to priority sector, World Economic Outlook, Study on Soil acidification published, Deposits of senior citizens, ‘Top 10 Busiest Airports Worldwide for 2023, Razorpay report, Exercise Dustlik, lightweight nozzle for rocket engines, debris-free space, World Voice Day, World Art Day 2024, World Quantum Day 2024, Prime Minister (PM) of Kuwait, Nalin Negi, Bihu, Jiadhal River, KG Jayan passes away, Max Health

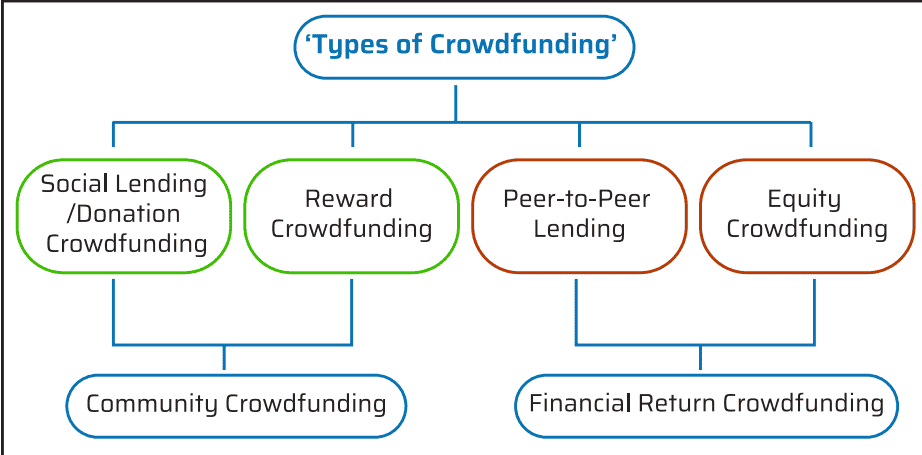

- The Gujarat High Court recently delved into the intriguing world of crowdfunding, seeking clarity on the legal framework surrounding this innovative method. The court was hearing a petition filed by Saket Gokhale, the national spokesperson of the Trinamool Congress and a Rajya Sabha MP.

- India has added a record renewable energy capacity of 18.48 GW in 2023-24, which is over 21 per cent higher than 15.27 GW a year ago, according to the latest data of the Ministry of New & Renewable Energy (MNRE).

- Sany Heavy Industry India Private Limited (SANY India), a construction and mining equipment manufacturer, has introduced the SKT105E, India’s first locally manufactured fully electric opencast mining truck.

- In a historic move, Nigeria has become the first country in the world to roll out a new vaccine (called Men5CV) recommended by the World Health Organization (WHO), which protects people against five strains of the meningococcus bacteria.

- United Kingdom (UK) to criminalize creation of intimate deepfake images

- Intel is set to release two AI chips, HL-328 and HL-388, tailored for the Chinese market, with reduced capabilities to comply with US export controls and sanctions.

- Microsoft is investing $1.5 billion in UAE-based artificial intelligence firm G42, acquiring a minority stake and a board seat, fostering deeper ties amidst the global tech competition.

- The Reserve Bank of India (RBI) has taken action against two co-operative banks: National Urban Co-operative Bank Ltd and Sarvodaya Co-operative Bank

- Bain Capital, a private equity firm, has sold its remaining 1.08% stake in Axis Bank for Rs 3,575 crore through an open market transaction.

- Jana Small Finance Bank (SFB) Limited has partnered with Kotak Mahindra Life Insurance Company Limited to provide life insurance products to its customers.

- State Bank of India Life Insurance Company Limited (SBILIFE) has launched its inaugural edition of IdeationX, an innovative initiative aimed at revolutionizing the future of the insurance industry.

- Bank of India (BOI) has entered into an agreement with India Mortgage Guarantee Corporation (IMGC) to offer mortgage guarantee-backed home loan products in the affordable housing segment.

- The National Stock Exchange (NSE) has delisted Zee Entertainment Enterprises (Zee) from the derivatives segment, meaning no new contracts for Zee will be issued for future expiry months.

- RBI and SEBI will form a committee to evaluate stability risks arising from a surge in derivatives markets and may propose policy changes if necessary.

- The Employees’ Provident Fund Organisation (EPFO) has recently made a significant change. They have doubled the eligibility limit for auto claim settlements under section 68J of the EPF Scheme 1952.

- India’s outward foreign direct investment (FDI) commitments rose significantly to $3.91 billion in March 2024, compared to $2.63 billion in March 2023. Sequentially, they were also higher than $3.67 billion in February 2024, according to Reserve Bank of India (RBI) data.

- The Reserve Bank of India (RBI) conducted a two-day variable rate reverse repo (VRRR) auction to address the liquidity surplus in the banking system, which neared approximately 1 trillion rupees.

- The advances of urban co-operative banks (UCBs) to the priority sector surged by over 27% in the financial year 2023 compared to the previous year, according to the Reserve Bank of India’s recent report the Reserve Bank of India’s recent report — Primary (Urban) Co-operative Banks’ Outlook 2022-23 — showed

- The International Monetary Fund (IMF) raised India’s GDP growth projection for 2024-25 by 30 basis points to 6.8 per cent in its update to the World Economic Outlook (WEO), citing buoyant domestic demand.

- In India, soil acidification might lead to loss of 3.3 billion tonnes of soil inorganic carbon (SIC) from the top 0.3 metres of its soil over the next 30 years, according to the study published in the journal Science.

- According to the State Bank of India (SBI) Economic Research Department (ERD) report, deposits in senior citizen accounts surged by 143% to Rs 34.367 lakh crore by December 2023 from Rs 13.724 lakh crore in 2018.

- Recently the Airports Council International (ACI) has released it’s report on the ‘Top 10 Busiest Airports Worldwide for 2023’ in the Passengers category.

- Recently Razorpay relesed it’s annual payments report titled “Wealth, Wellness, and Wanderlust”.

- The Indian Army contingent set off for the 5th edition of the India-Uzbekistan joint military Exercise DUSTLIK. Scheduled to take place in Termez, the Republic of Uzbekistan.

- The Vikram Sarabhai Space Centre (VSSC), part of the Indian Space Research Organisation (ISRO) based in Thiruvananthapuram, Kerala, has developed a lightweight Carbon-Carbon (C-C) nozzle for rocket engines.

- Indian Space Research Organisation (ISRO) Chairman S Somanath announced India’s goal to achieve debris-free space missions by 2030 during the 42nd Inter-Agency Space Debris Coordination Committee annual meet.

- World Voice Day (WVD) is globally observed on April 16 annually to celebrate the significance of the human voice and raise awareness about its care.

- World Art Day (WAD) is globally observed on April 15 annually to promote artistic expressions, recognize artists’ contributions to sustainable development, and strengthen the connection between art and society.

- World Quantum Day is annually observed across the globe on 14 April to raise public awareness and understanding of quantum science and technology around the world.

- Kuwait’s Emir, His Highness Sheikh Meshal Al-Ahmad Al-Jaber Al-Sabah, has issued an Emiri decree appointing Kuwaiti Economist Sheikh Ahmad Abdullah Al-Ahmad Al-Sabah as the Prime Minister (PM) of Kuwait.

- BharatPe, the fintech company, has elevated its interim chief executive officer (CEO) and chief financial officer Nalin Negi as full-time CEO.

- Assam celebrates Rongali Bihu

- The flow of Jiadhal River is being disrupted due to climate change.

- Padma Shri Awardee KG Jayan, a renowned Carnatic musician from Kerala, passed away at 89 in Ernakulam district, Kerala.

- Max Health to invest Rs. 2,500 crore in Lucknow

Table of Content

National News

- Gujarat High Court sought details on regulations around Crowdfunding

- What: The Gujarat High Court recently delved into the intriguing world of crowdfunding, seeking clarity on the legal framework surrounding this innovative method. The court was hearing a petition filed by Saket Gokhale, the national spokesperson of the Trinamool Congress and a Rajya Sabha MP.

Source: Indian Express

- What: The Gujarat High Court recently delved into the intriguing world of crowdfunding, seeking clarity on the legal framework surrounding this innovative method. The court was hearing a petition filed by Saket Gokhale, the national spokesperson of the Trinamool Congress and a Rajya Sabha MP.

- India adds record 18 GW renewable energy (RE) capacity in FY24

- What: India has added a record renewable energy capacity of 18.48 GW in 2023-24, which is over 21 per cent higher than 15.27 GW a year ago, according to the latest data of the Ministry of New & Renewable Energy (MNRE).

- However, there is a need to add at least 50 GW of renewable energy capacity annually for the next six years to meet the ambitious target of 500 GW of renewables by 2030.

- Tell me more:

- The MNRE is also targeting bidding of around 50 GW of renewable energy projects per annum to meet the ambitious target of 500 GW.

- The data showed that solar installations of 12.78GW led the renewable energy capacity addition of 15.27 GW in 2023-24, followed by 2.27 GW of wind energy.

- Among the renewable energy capacity, the total solar installed capacity tops the chart at 81.81GW, followed by about 46 GW of wind energy, 9.43 GW of biomass cogeneration and 5 GW of small hydro (up to 25 MW capacity each).

- Among the states, Gujarat and Rajasthan have the largest renewable energy capacities of about 27GW each, followed by Tamil Nadu at about 22 GW, Karnataka at about 21 GW and Maharashtra at about 17 GW.

Source: Business Standard

- India’s first locally manufactured fully electric opencast mining truck.

- What: Sany Heavy Industry India Private Limited (SANY India), a construction and mining equipment manufacturer, has introduced the SKT105E, India’s first locally manufactured fully electric opencast mining truck.

- The SKT105E is designed to endure the challenging conditions of open-cast mining operations.

Source: Financial Express

International News

- In world first, Nigeria introduces new 5-in-1 vaccine against meningitis

- What: In a historic move, Nigeria has become the first country in the world to roll out a new vaccine (called Men5CV) recommended by the World Health Organization (WHO), which protects people against five strains of the meningococcus bacteria.

- Meningitis is a serious infection that leads to the inflammation of the membranes (meninges) that surround and protect the brain and spinal cord.

- Tell me more:

- The vaccine and emergency vaccination activities are funded by Gavi, the Vaccine Alliance, which funds the global meningitis vaccine stockpile, and supports lower-income countries with routine vaccination against meningitis.

- Nigeria is one of the 26 meningitis hyper-endemic countries of Africa, situated in the area known as the African Meningitis Belt.

Source: WHO

- What: In a historic move, Nigeria has become the first country in the world to roll out a new vaccine (called Men5CV) recommended by the World Health Organization (WHO), which protects people against five strains of the meningococcus bacteria.

- United Kingdom (UK) to criminalize creation of intimate deepfake images

- Intimate deepfake images are fabricated images, typically created with artificial intelligence, that show someone in a sexually explicit situation. The key thing is that the person in the image never consented to being depicted that way.

Source: BBC

- Intimate deepfake images are fabricated images, typically created with artificial intelligence, that show someone in a sexually explicit situation. The key thing is that the person in the image never consented to being depicted that way.

- Intel to launch 2 AI chips for China market

- What: Intel is set to release two AI chips, HL-328 and HL-388, tailored for the Chinese market, with reduced capabilities to comply with US export controls and sanctions.

- Why: This move comes in response to tightened regulations imposed by the United States, which limit the capabilities of AI chips that can be exported to China.

Source: CNBC TV18

- Microsoft invests $1.5 bn in UAE’s G42

- What: Microsoft is investing $1.5 billion in UAE-based artificial intelligence firm G42, acquiring a minority stake and a board seat, fostering deeper ties amidst the global tech competition.

- Why: The investment aims to strengthen ties between the US and UAE amid concerns over China’s technological advancements and growing relations with Gulf states.

- Tell me more:

- The deal includes assurances to both US and UAE governments regarding security concerns.

- G42 will utilize Microsoft’s cloud services to power its AI applications.

- The partnership aligns with US efforts to counter China’s technological expansion.

Source: Yahoo Finance

Banking and Economy

- RBI imposes restrictions on several Urban Cooperative Banks (UCBs)

- What: The Reserve Bank of India (RBI) has taken action against two co-operative banks:

- National Urban Co-operative Bank Ltd and Sarvodaya Co-operative Bank

- Tell me more:

- National Urban Co-operative Bank Ltd in Pratapgarh, Uttar Pradesh:

- The withdrawal limit for customers has been capped at ₹10,000 due to the bank’s deteriorating financial situation.

- Sarvodaya Co-operative Bank in Mumbai:

- Withdrawals for customers have been capped at ₹15,0003.

- These measures are aimed at safeguarding the interests of depositors and ensuring stability in the banking system. The restrictions will remain in force for six months and are subject to review by the RBI.

Source: Business Standard

- National Urban Co-operative Bank Ltd in Pratapgarh, Uttar Pradesh:

- What: The Reserve Bank of India (RBI) has taken action against two co-operative banks:

- Bain Capital, has sold its remaining 1.08% stake in Axis Bank

- What: Bain Capital, a private equity firm, has sold its remaining 1.08% stake in Axis Bank for Rs 3,575 crore through an open market transaction.

- The transaction involved the sale of 33.37 million shares at Rs. 1,071 per share on the BSE (formerly Bombay Stock Exchange).

Source: Business Standard

- Jana Small Finance Bank partners with Kotak Mahindra Life to offer insurance products

- What: Jana Small Finance Bank (SFB) Limited has partnered with Kotak Mahindra Life Insurance Company Limited to provide life insurance products to its customers.

- The offerings will include long-term savings and retirement solutions.

Source: PIB

| Knowledge Nuggets - |

|---|

|

- Jana SFB, established in March 2018, is headquartered in Bengaluru, Karnataka, with Ajay Kanwal serving as MD & CEO. - Their tagline is "Likho Apni Kahani.” |

- SBI Life launches IdeationX

- What: State Bank of India Life Insurance Company Limited (SBILIFE) has launched its inaugural edition of IdeationX, an innovative initiative aimed at revolutionizing the future of the insurance industry.

- Why: The initiative aligns with the Insurance Regulatory and Development Authority of India’s (IRDAI) vision of ‘Insurance for All by 2047’, aiming to engage young minds from B-Schools nationwide to devise innovative solutions for emerging insurance needs.

- IdeationX seeks to reshape the insurance sector by providing opportunities for future leaders to contribute new product solutions, driving sustainable growth.

Source: ANI News

| Knowledge Nuggets - |

|---|

|

- SBI Life Insurance, established in October 2000 and registered with IRDAI in March 2001, is a leading insurance company headquartered in Mumbai, Maharashtra. - Amit Jhingran serves as the MD & CEO of SBI Life Insurance. |

- IMGC ties up with Bank of India to offer mortgage guarantee-backed home loan products

- What: Bank of India (BOI) has entered into an agreement with India Mortgage Guarantee Corporation (IMGC) to offer mortgage guarantee-backed home loan products in the affordable housing segment.

- Tell me more:

- The collaboration will extend to both salaried and self-employed home loan customers within the affordable housing segment.

- IMGC’s guarantee will mitigate the risk of defaults for BOI, enabling the bank to provide more favorable loan terms to borrowers.

- The partnership aims to promote financial inclusion and enhance access to homeownership for borrowers across India, thereby strengthening the credit delivery system.

Source: The Hindu Business Line

- Zee removed from F&O

- What: The National Stock Exchange (NSE) has delisted Zee Entertainment Enterprises (Zee) from the derivatives segment, meaning no new contracts for Zee will be issued for future expiry months.

- Why: This action follows Zee’s nearly halved share value since January, triggered by the collapse of its merger with Sony Pictures Networks India.

- Tell me more:

- NSE’s circular states that while fresh contracts for Zee won’t be issued, existing unexpired contracts for April 2024, May 2024, and June 2024 will remain available for trading until their respective expiry dates.

- Additionally, new strikes will be introduced in the existing contract months for Zee.

- The decision reflects the market’s response to the failed merger and its impact on Zee’s stock performance.

Source: Business Standard

- RBI, SEBI plan panel to weigh derivatives risk

- What: RBI and SEBI will form a committee to evaluate stability risks arising from a surge in derivatives markets and may propose policy changes if necessary.

- Why: The exponential growth in options trading in India, largely driven by retail investors, has raised concerns about potential systemic risks and the need for investor protection measures.

- Tell me more:

- The notional value of index options traded in 2023-24 more than doubled to $907.09 trillion from $447.69 trillion the previous year, according to NSE data.

- The committee will be established by the Financial Stability Development Council, comprising the finance minister, central bank governor, and SEBI.

- Members and reporting timelines for the committee will be finalized in the coming months.

- The committee’s primary focus will be to assess systemic risks, evaluate investor protection measures, and enhance regulatory oversight.

- Concerns about a potential correlation between the rise in small unsecured loans and options trading will be investigated.

- Specifically, scrutiny will be placed on the use of funds lent by non-banking finance companies with broking arms to determine if they contribute to capital market exposure.

Source: Money Control

- EPFO increases auto claims processing limit to Rs. 1 lakh

- What: The Employees’ Provident Fund Organisation (EPFO) has recently made a significant change. They have doubled the eligibility limit for auto claim settlements under section 68J of the EPF Scheme 1952.

- Auto claim settlement (EPFO) refers to the process where the Employees’ Provident Fund Organisation (EPFO) automatically approves and disburses claims for certain EPF categories without requiring manual intervention.

- Previously, subscribers could withdraw up to ₹50,000, but now they can claim up to ₹1,00,000. This enhancement is applicable to auto claims related to own and dependents’ medical expenses.

- Under Para 68J of the scheme, the amount advanced shall not exceed the member’s basic wages and dearness allowance for six months or his own share of contributions with interest thereon or the cost of the equipment, whichever is lower.

Source: Financial Express

- What: The Employees’ Provident Fund Organisation (EPFO) has recently made a significant change. They have doubled the eligibility limit for auto claim settlements under section 68J of the EPF Scheme 1952.

- India’s outward FDI rises to $3.91 bn in March: RBI data

- What: India’s outward foreign direct investment (FDI) commitments rose significantly to $3.91 billion in March 2024, compared to $2.63 billion in March 2023. Sequentially, they were also higher than $3.67 billion in February 2024, according to Reserve Bank of India (RBI) data.

- Outbound FDI, expressed as a financial commitment, comprises three components: equity, loans, and guarantees.

- The equity commitments grow more than twofold to $2.03 billion in March from $758.22 million a year ago. It was also higher than the $ 616.46 million recorded in February 2024.

- Debt commitments almost doubled to $1.04 billion in March, from $517.98 million a year ago, much higher than $254.24 million in February 2023.

- Guarantees for overseas units declined to $839.16 million in March 2024 from $1.36 billion in March 2023. They were down substantially compared to $2.80 billion in February 2024, RBI data showed.

Source: Business Standard

- What: India’s outward foreign direct investment (FDI) commitments rose significantly to $3.91 billion in March 2024, compared to $2.63 billion in March 2023. Sequentially, they were also higher than $3.67 billion in February 2024, according to Reserve Bank of India (RBI) data.

- RBI conducts 2-day VRRR as liquidity surplus nears Rs. 1 Trillion

- What: The Reserve Bank of India (RBI) conducted a two-day variable rate reverse repo (VRRR) auction to address the liquidity surplus in the banking system, which neared approximately 1 trillion rupees.

- The Variable Rate Reverse Repo (VRRR) auction is a tool used by the Reserve Bank of India (RBI) to manage liquidity in the banking system.

- Why: The surplus liquidity in the banking system reached around 98,920 crore rupees on Monday, prompting the RBI to conduct the auction to manage overnight money market rates and keep them near the repo rate.

- Tell me more:

- At the auction, banks parked approximately 32,576 crore rupees, below the notified amount of around 50,000 crore rupees, at a weighted average rate of 6.49%.

- Market participants anticipate surplus liquidity to persist in the current month, despite potential fluctuations due to elections.

- Liquidity has mostly remained in surplus in April compared to previous months in the current calendar year.

Source: Business Standard

- What: The Reserve Bank of India (RBI) conducted a two-day variable rate reverse repo (VRRR) auction to address the liquidity surplus in the banking system, which neared approximately 1 trillion rupees.

- UCB advances to priority sector jump 27% in FY23

- What: The advances of urban co-operative banks (UCBs) to the priority sector surged by over 27% in the financial year 2023 compared to the previous year, according to the Reserve Bank of India’s recent report the Reserve Bank of India’s recent report — Primary (Urban) Co-operative Banks’ Outlook 2022-23 — showed

- Why: This increase in lending to the priority sector, particularly to micro, small, and medium enterprises (MSMEs), reflects simplified credit rules for MSMEs and a significant rise in credit demand post-Covid.

- Tell me more:

- UCBs’ advances reached approximately Rs. 2.2 trillion in FY23, up from Rs. 1.73 trillion in FY22, with a majority of advances directed towards MSMEs.

- MSME lending by UCBs amounted to around Rs. 1.3 trillion in FY23, compared to Rs. 1 trillion in FY22, with micro enterprises receiving the highest share.

- UCBs mainly focus on lending to micro lenders and avoid large corporates due to their limited loan books.

- Of the total lending by UCBs to the priority sector, almost 40 per cent was to the MSMEs in FY23 compared to 34.27 per cent last year. Within MSMEs, micro enterprises had the highest share at 17.23 per cent.

- The RBI had set a target of 60% for priority sector lending by UCBs until FY24, which was surpassed with UCBs achieving 66.88% in FY23.

- Scheduled commercial banks achieved a priority sector lending (PSL) target of 44.7% as of March 31, 2023.

- The growth in MSME business post-Covid has contributed significantly to the increase in priority sector lending by both UCBs and scheduled commercial banks.

- As of March 31, 2023, there were 1,502 UCBs in India with a total of 10,117 branches, primarily concentrated in Maharashtra, which has the highest number of UCBs with a total of 475.

- UCBs collectively hold total deposits of around Rs. 5.3 trillion and total advances of approximately Rs. 3.3 trillion.

Source: Business Standard

- World Economic Outlook (WEO) released by IMF

- What: The International Monetary Fund (IMF) raised India’s GDP growth projection for 2024-25 by 30 basis points to 6.8 per cent in its update to the World Economic Outlook (WEO), citing buoyant domestic demand.

- For FY26, the growth for India is projected to 6.5 per cent.

- However, the fund’s estimate is below the 7 per cent growth projection by the government.

- For FY24, the IMF raised India’s GDP growth projection to 7.8 per cent, compared to 6.7 per cent in its January report.

Source: Reuters

Reports and Indices

- Study on Soil acidification published

- What: In India, soil acidification might lead to loss of 3.3 billion tonnes of soil inorganic carbon (SIC) from the top 0.3 metres of its soil over the next 30 years, according to the study published in the journal Science.

- Soil Acidification is a process by which soil pH decreases over-time.

Source: Down to Earth

- Soil Acidification is a process by which soil pH decreases over-time.

- What: In India, soil acidification might lead to loss of 3.3 billion tonnes of soil inorganic carbon (SIC) from the top 0.3 metres of its soil over the next 30 years, according to the study published in the journal Science.

- Deposits of senior citizens soared about 150% to ₹34 lakh crore in 5 years: SBI report

- What: According to the State Bank of India (SBI) Economic Research Department (ERD) report, deposits in senior citizen accounts surged by 143% to Rs 34.367 lakh crore by December 2023 from Rs 13.724 lakh crore in 2018.

- Tell me more:

- The report indicates that senior citizens term deposit accounts increased by approximately 81% to around 7.4 crore in December 2023 from 4.1 crore in 2018.

- Banks’ deposit insurance cover was increased from ₹1 lakh to ₹5 lakh with effect from February 4, 2020.

- An estimated 7.3 crore of these accounts hold a balance exceeding Rs 15 lakh, earning an interest of 7.5%, resulting in total interest earnings of Rs 2.7 lakh crore in Financial Year 2023-24 (FY24), including Rs 2.57 lakh crore from bank deposits and Rs 13,000 crore from the Senior Citizen Saving Scheme (SCSS).

- The average amount per senior citizen term deposit account rose by about 39% to Rs 4.63 lakh by December 2023 from Rs 3.34 lakh in 2018.

- The report highlights that the Government collected approximately Rs 27,000 crore in taxes from senior citizens on the interest earned on term deposits in FY24, with the threshold of TDS (Tax Deducted at Source) on deposits increased to Rs 50,000 by the Government of India (GoI).

- The attractiveness of bank deposits to senior citizens is further enhanced by a 50 basis points hike in additional interest rate and an increase in deposit insurance cover from Rs 1 lakh to Rs 5 lakh, effective from February 4, 2020.

Source: The Hindu Business Line

- Airports Council International (ACI) World released its report on the ‘Top 10 Busiest Airports Worldwide for 2023

- What: Recently the Airports Council International (ACI) has released it’s report on the ‘Top 10 Busiest Airports Worldwide for 2023’ in the Passengers category.

- Tell me more:

- In 2023, the Indira Gandhi International Airport (IGIA) in New Delhi claimed the 10th spot among the world’s busiest airports, according to the Airports Council International (ACI).

- This ranking is based on the number of passengers handled by each airport throughout the year IGIA witnessed a staggering 7.22 crore passengers during 2023.

Source: Live Mint

- Wealth management, entertainment, and health spends grow in FY24

- What: Recently Razorpay relesed it’s annual payments report titled “Wealth, Wellness, and Wanderlust”.

- The report states that in the financial year 2024 (FY24), there was a significant surge in transactions across various verticals, including wealth management, insurance, health, and entertainment, when compared to FY23.

- Tell me more:

- Mutual fund investments surged by 86% year-on-year.

- Insurance payments grew by 56%, while trading recorded a 62% jump in value in FY24.

- Health-related Spending: The expenditure on dieticians more than doubled, while health coaching transactions increased by 45%.

- Holistic Well-being: There was a 39% uptick in products related to preventive healthcare, emphasizing a collective shift towards overall well-being.

Source: Business Standard

Defence News

- India-Uzbekistan Joint Ex -DUSTLIK

- What: The Indian Army contingent set off for the 5th edition of the India-Uzbekistan joint military Exercise DUSTLIK. Scheduled to take place in Termez, the Republic of Uzbekistan.

- Ex-DUSTLIK, conducted alternately in India and Uzbekistan.

- Last edition: Held in Pithoragarh, India, in February 2023

Source: Financial Express

| Knowledge Nuggets - |

|---|

|

- The currency of Uzbekistan is the Uzbekistani Som - The capital of Uzbekistan is Tashkent. |

Science and Tech

- ISRO scientists create new lightweight nozzle for rocket engines

- The Vikram Sarabhai Space Centre (VSSC), part of the Indian Space Research Organisation (ISRO) based in Thiruvananthapuram, Kerala, has developed a lightweight Carbon-Carbon (C-C) nozzle for rocket engines.

- This development is a significant advancement in rocket engine technology, promising enhanced thrust levels, specific impulse, and thrust-to-weight ratios, thus increasing the payload capacity of launch vehicles.

- This development is projected to increase the payload capacity of PSLV by 15 kg, offering significant benefits for future space missions.

Source: WION

- India aims to achieve debris-free space missions by 2030: ISRO chief

- What: Indian Space Research Organisation (ISRO) Chairman S Somanath announced India’s goal to achieve debris-free space missions by 2030 during the 42nd Inter-Agency Space Debris Coordination Committee annual meet.

- Why: This initiative aims to enhance space exploration and utilization while mitigating risks associated with space debris, signaling ISRO’s commitment to responsible space activities.

Source: NDTV

Important Days

- April 16: World Voice Day

- What: World Voice Day (WVD) is globally observed on April 16 annually to celebrate the significance of the human voice and raise awareness about its care.

- The theme for 2024:“Resonate. Educate. Celebrate!” chosen by the Voice Committee of the American Academy of Otolaryngology-Head and Neck Surgery (AAO-HNS).

Source: The Quint

| Knowledge Nuggets - |

|---|

|

• AAO-HNS, headquartered in Alexandria, Virginia (USA), • Founded in 1896, AAO-HNS continues to advocate for the importance of voice care |

- April 15: World Art Day 2024

- What: World Art Day (WAD) is globally observed on April 15 annually to promote artistic expressions, recognize artists’ contributions to sustainable development, and strengthen the connection between art and society.

- The International Association of Art/Association Internationale des Arts Plastiques (IAA/AIAP), in collaboration with UNESCO, leads the annual celebration.

Source: The Quint

| Knowledge Nuggets - |

|---|

|

- The IAA/AIAP was established in Beirut, Lebanon, in 1948 during UNESCO's 3rd General Conference and became an independent organization in 1954, recognized as a UNESCO partner. - Kwang Soo Lee from Korea serves as the President of IAA/AIAP, which is headquartered in Paris, France. |

- April 14: World Quantum Day 2024

- World Quantum Day is annually observed across the globe on 14 April to raise public awareness and understanding of quantum science and technology around the world.

Source: Qunatum.gov

- World Quantum Day is annually observed across the globe on 14 April to raise public awareness and understanding of quantum science and technology around the world.

Appointment

- Kuwait’s Emir Names Sheikh Ahmad Abdullah Al Sabah As Prime Minister

- What: Kuwait’s Emir, His Highness Sheikh Meshal Al-Ahmad Al-Jaber Al-Sabah, has issued an Emiri decree appointing Kuwaiti Economist Sheikh Ahmad Abdullah Al-Ahmad Al-Sabah as the Prime Minister (PM) of Kuwait.

- His appointment follows the resignation of former PM Sheikh Dr. Mohammed Sabah Al Salem Al-Sabah, who stepped down after the new parliamentary election in April 2024.

Source: ABP Live

- BharatPe appoints Nalin Negi full-time chief executive

- What: BharatPe, the fintech company, has elevated its interim chief executive officer (CEO) and chief financial officer Nalin Negi as full-time CEO.

- Negi, who previously served as the Chief Financial Officer (CFO) of the company, took over as the interim CEO in January 2023 after the departure of then-CEO Suhail Sameer.

Source: Business Standard

Miscellaneous

- Assam celebrates Rongali Bihu

- About Rongali/Bohag Bihu

- Celebrated in middle of April, it marks the beginning of Assamese New Year and onset of spring.

- There are 3 Bihu festivals in Assam. Other two- Kati Bihu and Magh Bihu are celebrated in October and January, respectively.

Source: Indian Express

- About Rongali/Bohag Bihu

- Jiadhal River

- What: The flow of Jiadhal River is being disrupted due to climate change.

Source: Down to Earth

- What: The flow of Jiadhal River is being disrupted due to climate change.

| Knowledge Nuggets - |

|---|

|

About Jiadhal River - It is a north-bank tributary of Brahmaputra. - Originates in lower Himalayan ranges in Arunachal Pradesh. - Flows through Assam and meets Brahmaputra near Majuli Island. |

- Veteran carnatic musician, singer KG Jayan passes away

- What: Padma Shri Awardee KG Jayan, a renowned Carnatic musician from Kerala, passed away at 89 in Ernakulam district, Kerala.

- KG Jayan was honored with the Padma Shri, India’s fourth highest civilian award, in 2019 for his contributions to the arts.

Source: Indian Express

- Max Health to invest Rs. 2,500 crore in Lucknow

- The new investment will be part of the plan to double capacity by adding 4,200 beds in the next four to five years for an investment of more than Rs. 5,000 crore.

Source: Business Standard

- The new investment will be part of the plan to double capacity by adding 4,200 beds in the next four to five years for an investment of more than Rs. 5,000 crore.

About Anuj Jindal

━━━━━

Anuj Jindal, the founder, is an ex-manager from SBI, with an M.Com from Delhi School of Economics. He also has a JRF in Commerce & Management and NET in HRM, along with more than 5 years of experience in the field of Education.

0 Comments